capital gains tax changes 2021 canada

One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market. Youre then taxed based on your particular provinces tax bracket.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

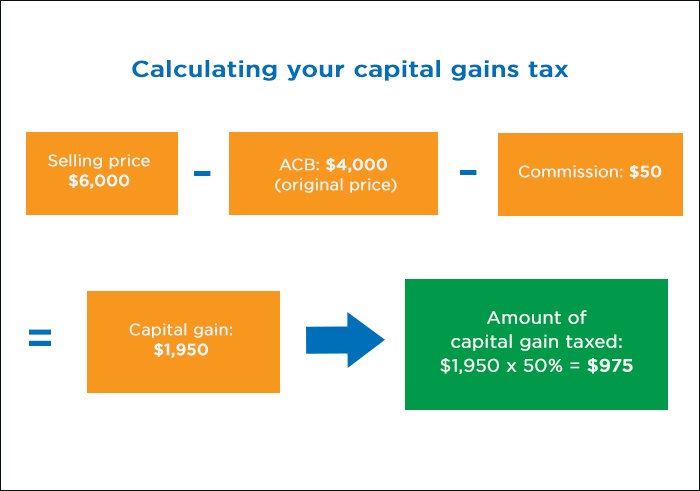

In other words if you sell an investment at a higher price than you paid realized capital gains youll have to add 50 of the capital gains to your income.

. A report this summer from the Parliamentary Budget Officer estimated a wealth tax of 1 on. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of 35. The Federal government website says the following about Capital Gains changes in 2021.

For tax purposes the gain would only be half of 35. However if their annual income is between 40401 and 445850 they will be subject to a capital gains tax of 15. The sale of primary residences are currently exempt from capital gains taxes.

Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. 3 Major Tax Changes Coming in 2021 appeared first on The Motley Fool Canada. Multiply 5000 by the tax rate listed according to your annual income minus any.

As the CRA offers you more room to invest deploy this extra tax-shielded cash wisely. There has been much anticipation and speculation regarding the upcoming Budget as the previous budget was. Capital gains tax changes 2021 canada.

They have increased the Lifetime Capital Gains Exemption Limit LCGE For dispositions in 2020 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to. The tax is calculated at the lesser of 20 of the value above those thresholds or 10 of the full value of that car boat or personal aircraft Golombek said. When this minimum tax is greater than the net federal tax it replaces the net federal tax and for Quebec.

On March 22 2021 the Finance Minister Chrystia Freeland finally announced the date of the federal budget the Budget to be April 19th 2021. The 2021 federal budgetpresented on 19 April 2021does not propose any changes to the federal individual personal or corporate tax rates but would extend certain relief programs offered in response to the coronavirus COVID-19 pandemic. Its been paying dividends for more than 140 years and increased the payment for 25 consecutive years.

Although the concept of capital gains tax is not new to Canadians there have been several. Only half of it is taxable so you will add 17500 to your taxable income for the year. Both taxes will take effect on Jan.

Accordingly the actual income that you would be taxed on at your marginal tax rate would be 1750. Upcoming Federal Budget April 19th Planning For Possible Capital Gains Tax Increase. Capital Gains Tax Rate.

Other tax measures in the budget would impose or implement interest expense. Guidance on affidavits and valuations Bill C-208. After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on.

The CPP contribution rate for workers increases to 545 in 2021 or a total of 1090 when combined with the employer rate. As of September 7 2021 the share price is 3397 a. 2021 Federal Budget On the trail of possible tax changes.

Canadas Deputy Prime Minister and Finance Minister Chrystia Freeland will deliver Canadas 2021 federal budget on April 19 2021. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Details on a new 1 annual tax on the unproductive use of Canadian housing by foreign owners will come in the months ahead he said.

16 Top TSX Stocks to Buy in November 2020. If you sold the property for 560000 you incurred a 35000 profit Capital Gains 560000 Proceeds 525000 ACB. Generally capital gains are taxed on half of the gain.

In Canada 50 of the value of any capital gains are taxable. Possible Changes Coming to Tax on Capital Gains in Canada. 2021 Federal Budget Possible tax changes.

What is the capital gains exemption for 2021. Canadas debt set to cross 1 trillion mark as Liberals extend COVID-19 aid in budget. The maximum pensionable earnings is 64900 an increase of 3300 from the 61600 in 2021.

Your earnings from the property and the cost of maintaining the property will not change the ACB. The phase-in rate was increased from 26 per cent to 27 per cent for single individuals without dependents as well as families. The CRA enhanced the Basic Personal Amount BPA in 2021 allowing Canadian taxpayers to save 570 from the incoming tax bill.

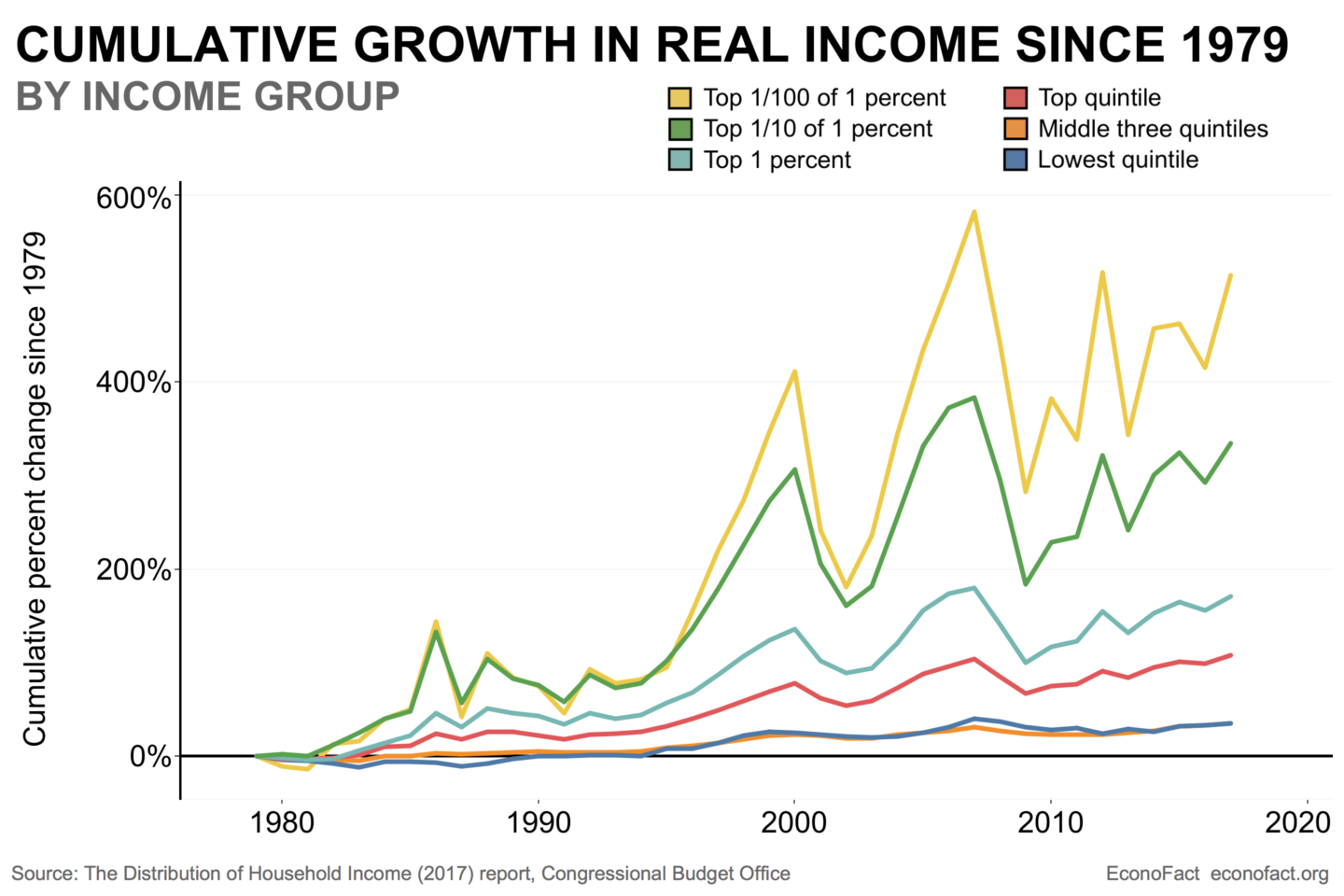

Over the last year there has been considerable speculation like most other things these days about the Federal Government increasing the inclusion rate of capital gains tax in Canada. The phase-out thresholds was increased from 13194 to 22944 for single individuals without dependents and. Changes to the RRSP and CPP have already been announced and were waiting on an update to the TFSA shortly.

The basic exemption amount remains at. The changes are in effect for 2021 for the 202o tax year. Canadian real estate and capital gains taxes are once again.

In Canada 50 of the value of any capital gains is taxable. Capital gains tax rates by province below. Lifetime capital gains exemption limit.

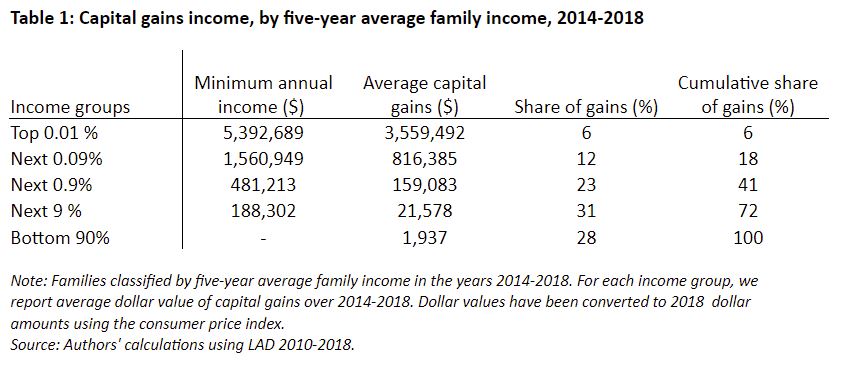

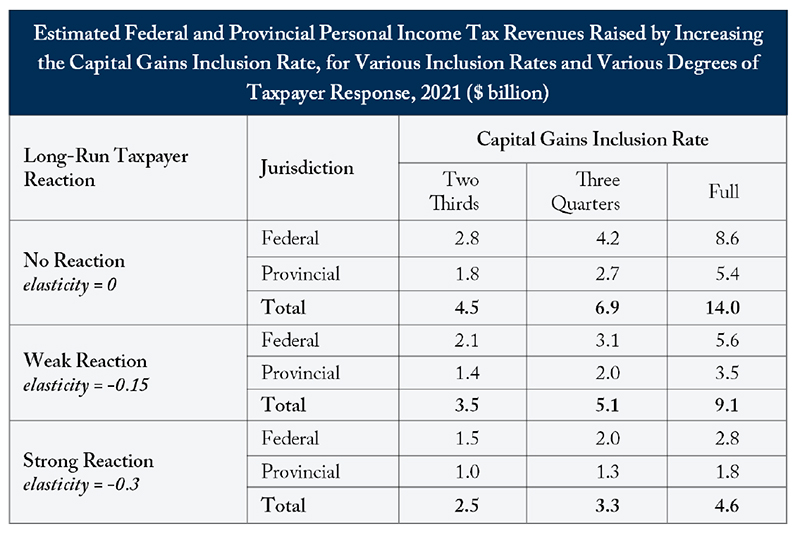

Here in Canada British Columbia already has a wealth tax of sorts on real estate valued over 3 million. As the government of canada prepares to present its 2021 budget on april 19 2021 taxpayers should be aware of how potential increases to the capital gains inclusion rate may affect their tax liability regarding dispositions of capital property. For more information see What is the capital gains deduction limit.

This new proposed minimum tax appears to limit the benefits of all credits except for the foreign tax credit and would be calculated as 15 of taxable income for individuals in the top marginal tax bracket ie with taxable income in excess of 216511 for 2021. For instance in 2021 individuals who file tax returns will be exempt from paying any kind of capital gains tax if their total taxable income is less than 40400. The medium-term plan is to reduce taxes to the extent that 11.

For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 892218. April 20 2021.

2022 Capital Gains Tax Rates In Europe Tax Foundation

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Canada Tax Income Taxes In Canada Tax Foundation

Difference Between Income Tax And Capital Gains Tax Difference Between

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

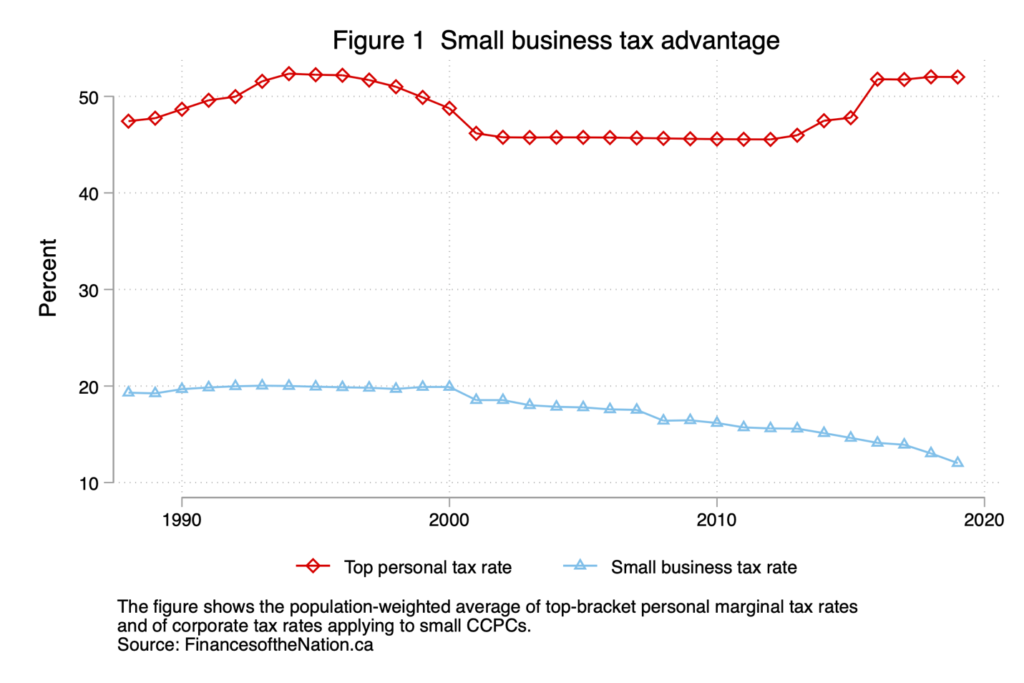

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

How High Are Capital Gains Taxes In Your State Tax Foundation

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Alexandre Laurin The Impact Of Taxpayers Reaction To A Capital Gains Tax Increase C D Howe Institute Canada Economy News Canadian Government Policy

Capital Gains Tax Calculator 2022 Casaplorer

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

The States With The Highest Capital Gains Tax Rates The Motley Fool

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Tax Advantages For Donor Advised Funds Nptrust

Capital Gains Tax What Is It When Do You Pay It

Canada Tax Income Taxes In Canada Tax Foundation

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube